金程FRM讲师给大家分享风险管理基础试题及解析

备考FRM一级 | 2020-04-23

金程FRM讲师给大家分享风险管理基础试题及解析,都是一些基础的练习题,如果刚入门风险管理的学生可以多做一些这类的习题,还有解答哦!

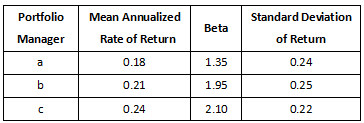

Q-1.Donaldson Capital Management,a regional money management firm,manages nearly$400 million allocated among three investment managers.All portfolios have the same objective,which is to produce superior risk-adjusted returns(by beating the market)for their clients.You have been hired as a consultant to measure the performance of the portfolio managers.You have collected the following information based on the last ten years of returns.

During the same time period the average annual rate of return on the market portfolio was 13%with a standard deviation of 19%.In order to assess the portfolio performance of the above managers,you should use:》》》想领取整套风险管理基础试题的的点我咨询

A.The Treynor measure of performance

B.The Sharpe measure of performance

C.The Jensen measure of performance

D.The Sortino measure of performance

Solution:B

The Treynor measure is most appropriate for comparing well-diversified portfolios.That is the Treynor measure is the best to compare the excess returns per unit of systematic risk earned by portfolio managers,provided all portfolios are well-diversified.

All three portfolios managed by Donaldson Capital Management are clearly less diversified than the market portfolio.Standard deviation of returns for each of the three portfolios is higher than the standard deviation of the market portfolio,reflecting a low level of diversification.

Jensen’s alpha is the most appropriate measure for comparing portfolios that have the same beta.The Sharpe measure can be applied to all portfolios because it uses total risk and it is more widely used than the other two measures.Also,the Sharpe ratio evaluates the portfolio performance based on realized returns and diversification.A less-diversified portfolio will have higher total risk and vice versa.

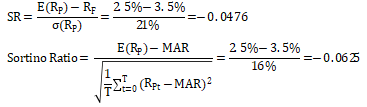

Q-2.A portfolio manager received a report on his fund’s performance.According to the report,the portfolio return was 2.5%with a standard deviation of 21%and a beta of 1.2.The risk-free rate over this period was 3.5%,the semi-standard deviation of the portfolio was 16%,and the tracking error of the fund was 2%.What is the difference between the value of the fund’s Sortino ratio(assuming the risk-free rate is the minimum acceptable return)and its Sharpe ratio?

A.0.563

B.0.347

C.-0.053

D.-0.015

Solution:D

The difference between these two ratios is:—0.0625—(-0.0476)=-0.0149.

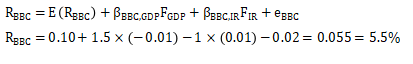

Q-3.Suppose an analyst examines expected return for the Broad Band Company(BBC)base on a 2-factor model.Initially,the expected return for BBC equals 10%.The analyst identifies GDP and 10-year interest rates as the two factors for the factor model.Assume the following data is used:

GDP growth consensus forecast=6%

Interest rate consensus forecast=3%

GDP factor beta for BBC=1.5

Interest rate factor beta for BBC=-1.00

Suppose GDP ends up growing 5%and the 10-year interest rate ends up equaling 4%.Also assume that during the period,the Broad Band Company unexpectedly experiences shortage of key inputs,causing its revenues to be less than originally expected.Consequently,the firm-specific return is-2%during the period.Using the 2-factor model with the revised data,which of the following updated expected returns next year for BBC is correct?

A.1.5%

B.3.5%

C.5.5%

D.6.5%

Solution:C

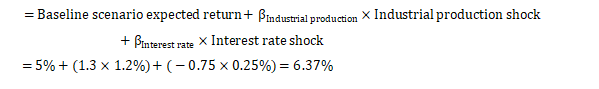

Q-4.An analyst is estimating the sensitivity of the return of stock A to different macroeconomic factors.He prepares the following estimates for the factor betas:

![]()

Under baseline expectations,with industrial production growth of 3%and an interest rate of 1.5%,the expected return for Stock A is estimated to be 5%.

The economic research department is forecasting an acceleration of economic activity for the following year,with GDP forecast to grow 4.2%and interest rates increasing 25 basis points to 1.75%.

What return of Stock A can be expected for next year according to this forecast?

A.4.8%

B.6.4%

C.6.8%

D.7.8%

Solution:B

The expected return for Stock A equals the expected return for the stock under the baseline scenario,plus the impact of"shocks",or excess returns of,both factors.Since the baseline scenario incorporates 3%industrial production growth and a 1.5%interest rate,the"shocks"are 1.2%for the GDP factor and 0.25%for the interest rate factor.》》》想参加FRM入门网课培训的点我咨询

(如果没收到资料,可以点我咨询)

备注:(FRM备考资料包含:1、FRM专用英语词汇 2、FRM一二级专用公式表 3、FRM前导课程4、FRM报名流程指引图 5、FRM电子版资料 6、FRM考纲 7、FRM笔记)

FRM全球交流QQ群:126414035。最新FRM资料&资讯随时分享,与众多FRM备考或持证人交流考试经验。

声明|本文由金程FRM综合采编自网络。我们尊重原创,重在分享。部分文字和图片来自网络。

相关标签 FRM一级