FRM风险管理基础习题+详情解答

行业资讯 | 2020-04-14

FRM风险管理基础习题+详情解答

我们都知道想要考过FRM金融风险管理师,做题这一项是很关键的,也是比较重要的,今天FRM小编给大家出几条有关FRM金融风险基础练习题以及解答,希望可以帮助大家。》》在线领取整套金融风险基础练习题

.jpg)

Q-1.Patricia Franklin makes buy and sell stock recommendations using the capital asset pricing model.Franklin has derived the following information for the broad market and for the stock of the CostSave Company(CS):

Expected market risk premium 8%

Risk-free rate 5%

Historical beta for CostSave 1.50

Franklin believes that historical betas do not provide good forecasts of future beta,and therefore uses the following formula to forecast beta:

Forecasted beta=0.80+0.20×historical beta

After conducting a thorough examination of market trends and the CS financial statements,Franklin predicts that the CS return will equal 10%.Franklin should derive the following required return for CS along with the following valuation decision(undervalued or overvalued):

Valuation CAPM required return

A.overvalued 8.3%

B.overvalued 13.8%

C.undervalued 8.3%

D.undervalued 13.8%

Solution:B

The CAPM equation is:.Franklin forecasts the beta for CostSave as follows:beta forecast=0.80+0.20 historical beta=0.80+0.20×1.50=1.10

The CAPM required return for CostSave is:0.05+1.1×0.08=13.8%

Note that the market premium,,is provided in the question(8%).

Franklin should decide that the stock is overvalued because she forecasts that the CostSave return will equal only 10%,whereas the required return(minimum acceptable return)is 13.8%.

Q-2.Which of the following statements concerning the capital asset pricing model(CAPM)and the security market line(SML)is correct?

A.Beta identifies the appropriate level of risk for which an investor should be compensated.

B.Unsystematic risk is not diversifiable,so there is no reward for taking on such risk.

C.Assets with equivalent betas will always earn different returns.

D.The market risk premium is calculated by multiplying beta by the difference between the expected return on the market and the risk-free rate of return.

Solution:A

Beta identifies the appropriate level of risk for which an investor should be compensated.Unsystematic risk is asset-specific and,therefore,a diversifiable risk.The market risk premium is calculated as the excess of the expected return on the market over the risk-free rate of return.Assets with equivalent betas should earn the same return because arbitrage will prevent assets with the same risk from earning different returns.

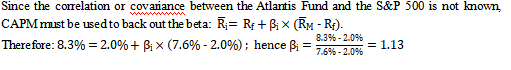

Q-3.Suppose the S&P 500 has an expected annual return of 7.6%and volatility of 10.8%.Suppose the Atlantis Fund has an expected annual return of 8.3%and volatility of 8.8%and is benchmarked against the S&P 500.If the risk free rate is 2.0%per year,what is the beta of the Atlantis Fund according to the Capital Asset Pricing Model?

A.0.81

B.0.89

C.1.13

D.1.23

Solution:C

Solution:D

The ability to borrowing or lend morphs the concave/convex efficient frontier into the linear CML;i.e.,the leveraged portfolio is efficient with higher risk and higher return.

All portfolios on the CML have the same Sharpe ratio:the slope of the CML.

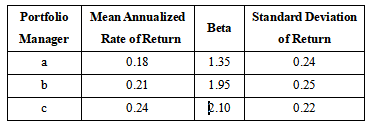

Q-4.Donaldson Capital Management,a regional money management firm,manages nearly$400 million allocated among three investment managers.All portfolios have the same objective,which is to produce superior risk-adjusted returns(by beating the market)for their clients.You have been hired as a consultant to measure the performance of the portfolio managers.You have collected the following information based on the last ten years of returns.

During the same time period the average annual rate of return on the market portfolio was 13%with a standard deviation of 19%.In order to assess the portfolio performance of the above managers,you should use:

A.The Treynor measure of performance

B.The Sharpe measure of performance

C.The Jensen measure of performance

D.The Sortino measure of performance

Solution:B

The Treynor measure is most appropriate for comparing well-diversified portfolios.That is the Treynor measure is the best to compare the excess returns per unit of systematic risk earned by portfolio managers,provided all portfolios are well-diversified.

All three portfolios managed by Donaldson Capital Management are clearly less diversified than the market portfolio.Standard deviation of returns for each of the three portfolios is higher than the standard deviation of the market portfolio,reflecting a low level of diversification.

Jensen’s alpha is the most appropriate measure for comparing portfolios that have the same beta.The Sharpe measure can be applied to all portfolios because it uses total risk and it is more widely used than the other two measures.Also,the Sharpe ratio evaluates the portfolio performance based on realized returns and diversification.A less-diversified portfolio will have higher total risk and vice versa.

(如果没收到资料,可以点我咨询)

备注:(FRM备考资料包含:1、FRM专用英语词汇 2、FRM一二级专用公式表 3、FRM前导课程4、FRM报名流程指引图 5、FRM电子版资料 6、FRM考纲 7、FRM笔记)

FRM全球交流QQ群:126414035。最新FRM资料&资讯随时分享,与众多FRM备考或持证人交流考试经验。

声明|本文由金程FRM综合采编自网络。我们尊重原创,重在分享。部分文字和图片来自网络。

相关标签 FRM一级