金融债券与基础衍生品精选试题解析

行业资讯 | 2020-03-24

什么是金融债券?

金融债券是指银行及其他金融机构所发行的债券。金融债券期限一般为3~5年,其利率略高于同期定期存款利率水平。金融债券由于其发行者为金融机构,因此资信等级相对较高,多为信用债券。

债券按法定发行手续,承诺按约定利率定期支付利息并到期偿还本金。它属于银行等金融机构的主动负债。

.jpg)

什么是衍生品?

衍生产品是一种金融工具,一般表现为两个主体之间的一个协议,其价格由其他基础产品的价格决定。并且有相应的现货资产作为标的物,成交时不需立即交割,而可在未来时点交割。典型的衍生品包括远期,期货、期权和互换等。

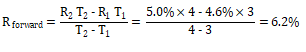

Q-1.The zero rate of three years is 4.6%,the zero rate of four years is 5.0%.Please calculate the 1-year forward rate three years from today(continuously compounding).》》点击领取债券与基础衍生品精选试题

A.6.2%

B.6.0%

C.5.5%

D.4.8%

Solution:A

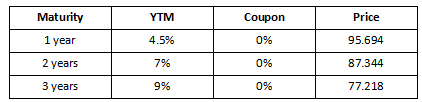

Q-2.Given the following bonds and forward rates:

1-year forward rate one year from today=9.56%

1-year forward rate two years from today=10.77%

2-year forward rate one year from today=11.32%

Which of the following statements about the forward rates,based on the bond prices,is true?

The 1-year forward rate one year from today is too low.

The 2-year forward rate one year from today is too high.

The 1-year forward rate two years from today is too low.

The forward rates and bond prices provide no opportunities for arbitrage.

Solution:C

1-year forward rate one year from today=1.072/1.045–1=9.56%

1-year forward rate two years from today=1.093/1.072–1=13.11%

2-year forward rate one year from today=(1.093/1.045)0.5–1=11.32%

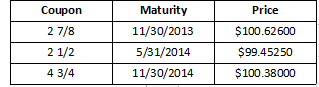

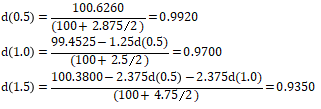

Q-3.The table below gives coupon rates and mid-market price for three U.S.Treasury bonds for settlement on(as of)May 31,2013

Which of the following is nearest to the implied discount function(set of discount factors)assuming semi-annual compounding?

A.d(0.5)=0.9370,d(1.0)=0.8667,d(1.5)=0.9210

B.d(0.5)=0.9920,d(1.0)=0.9700,d(1.5)=0.9350

C.d(0.5)=0.9999,d(1.0)=0.7455,d(1.5)=0.8018

D.d(0.5)=1.0350,d(1.0)=1.1175,d(1.5)=0.6487

Solution:B

The future value of$1 invested for time t is 1/d(t).

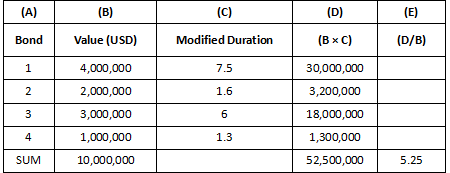

Q-4.Calculate the impact of a 10 basis point increase in yield on the following bond portfolio.

A.USD-41,000

B.USD-52,500

C.USD-410,000

D.USD-525,000

Solution:B

The portfolio modified duration is 5.25.This is obtained by multiplying the value of each bond by the modified duration(s),then taking the sum of these products,and dividing it by the value of the total bond portfolio.

The change in the value of the portfolio will be-10,000,000×5.25×0.1%=-52,500

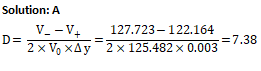

Q-5.A portfolio manager uses her valuation model to estimate the value of a bond portfolio at USD 125.482 million.The term structure is flat.Using the same model,she estimates that the value of the portfolio would increase to USD 127.723 million if all interest rates fell by 30 basis points and would decrease to USD 122.164 million if all interest rates rose by 30 basis points.Using these estimates,the effective duration of the bond portfolio is closest to:

A.7.38

B.8.38

C.14.77

D.16.76

(如果没收到资料,可以点我咨询)

备注:(FRM备考资料包含:1、FRM专用英语词汇 2、FRM一二级专用公式表 3、FRM前导课程4、FRM报名流程指引图 5、FRM电子版资料 6、FRM考纲 7、FRM笔记)

FRM全球交流QQ群:126414035。最新FRM资料&资讯随时分享,与众多FRM备考或持证人交流考试经验。

声明|本文由金程FRM综合采编自网络。我们尊重原创,重在分享。部分文字和图片来自网络。

相关标签 FRM一级