世界经济论坛:地缘政治风险正在上升

行业资讯 | 2019-02-20

《2019年世界经济论坛全球风险报告》描绘了一幅复杂、激烈且相互关联的风险图景——其中最紧迫的风险是“地缘政治和地缘经济的紧张局势”,以及一个显然缺乏“解决这种紧张局势所需的集体意愿”的世界。该报告将风险分为五个关键类别,分别是经济、地缘政治、社会政治、环境和科技风险,并指出了13个风险趋势。

虽然我们面临的近期和长期的风险问题都很复杂,但世界经济论坛年度“全球风险系列”的第14次报告认为,解决方案其实相对简单,它应该以合作与协作为中心。

“我们从未像现在这样迫切需要与各个利益相关方紧密协作,以便解决我们共同面临的全球问题,”世界经济论坛主席博尔格。布伦德(B?rge Brende)在报告的序言中写道。

“这是一个无与伦比时代,资源和技术取得了长足的进步,但对于太多人,这也是一个不安全的时代,”布伦德认为。 “我们需要新的全球化路径来应对这种不安全感……更新和改进国内和国际的政治、经济体系架构是我们这一代人的决定性任务。”》》更多金融风险证书相关问题点我咨询

世界经济论坛风险报告的“风险和趋势”

The WEF and its Global Risks Perception Survey break down the global risk landscape into five key categories: economic, geopolitical, societal and political, environmental, and technological. Within those categories are a total of 30 global risks for 2019 (for example, asset bubbles and deflation under economic, and interstate conflict and terrorist attacks under geopolitical)。

There are also 13 trends – “defined as a long-term pattern that is currently evolving and that could contribute to amplifying global risks and/or altering the relationship between them” – such as aging population, changing climate, and rising cyber dependency.

Geopolitical tensions, coupled with geo-economic concerns, are viewed as the most urgent global risk. Respondents to the Global Risks Perception Survey – described as “nearly 1,000 decision-makers from the public sector, private sector, academia and civil society” – saw current nationalist agendas as creating dangerous international friction. Examples are recent U.S.-China trade talks and tensions between Turkey and Saudi Arabia. Trade wars, sanctions and other disruptions in business and investment relationships could have a negative impact on the global economy.

普华永道年度CEO问卷:贸易争端是首要风险

Such concerns are rising to the top in other benchmark surveys. In PwC's 22nd annual Global CEO Survey – released, like Global Risks 2019, just ahead of the WEF's January Davos gathering – trade conflicts, policy uncertainty, and protectionism replaced terrorism, climate change, and increasing tax burden on the list of top 10 threats to growth.

Of PwC's responding CEOs “extremely concerned” about trade conflicts, 88% were specifically uneasy about that between China and the U.S.; 98% of U.S. CEOs and 90% of China's CEOs voiced these concerns.

The more than 1,300 survey participants turned significantly more pessimistic about the economy this year, with nearly 30% expecting a decline in global growth, versus 5% in 2018. Still, 42% see an improved economic outlook, though that is down from 57% a year ago.

Political and security risk consulting firm Control Risks, in its RiskMap 2019 forecast, placed “U.S.-China trade rift foretells a new global order” as No. 1 among its top five risksfor this year. “This antagonistic relationship will complicate life not only for businesses in China and the U.S.,” the firm said. “Companies in a wide orbit around this standoff will feel the political and economic impact.”

最可能发生和影响最大的风险

John Drzik, president of global risk and digital at Marsh, a unit of Marsh & McLennan Companies, which is a WEF report partner, says, “As a result of these tensions, companies are being increasingly pulled into the ring of political wrangling. To a degree that we have not seen in modern times, they find themselves in the crosshairs of politicians.” This creates a demanding and volatile business environment and puts pressure on profitability.

The WEF report lists five risks as most likely to occur: extreme weather events; failure of climate change mitigation and adaptation; natural disasters; data fraud and theft; and cyber attacks.

The top five in terms of impact: weapons of mass destruction; failure of climate change mitigation and adaptation; extreme weather events; water crises; and natural disasters.

“Asset bubbles in a major economy” ranked 10th in likelihood but was not in the top 10 in impact.

对商业公司的意义何在?

Brian Elowe, Marsh's chief client officer for North America, says that these global risks have important risk management implications for businesses.

One is the need to address the impact of multiple environmental risks. This will require companies to create greater resilience in their organizations and supply chains and to become more adept at anticipating resource shortages around the globe. “Companies can no longer avoid the implications of climate risk,” he says.

In “Climate Change Challenges for Central Banks and Financial Regulators,” a paper published last year in Nature Climate Change, Emanuele Campiglio and co-authors explored the relationship between climate change and the stability of the financial system.

Another implication, Elowe says, is the need to anticipate massive cyberattacks, some of which may be state-sponsored. Companies will need to focus on the vulnerabilities and resiliency of their infrastructure as well as those of their supply chain and value chain, he says.

“There is certainly a rising concern about targeted attacks on organizations and the impact of new technologies such as artificial intelligence in creating new vulnerabilities,” or as an accelerant to a cyber attack, Elowe adds.

政治风险需引起重视

A third important risk management consideration is the challenging political and economic environment, coupled with what Elowe calls “headwinds in the global economy that will put pressure on corporate strategies and investments.” It will therefore become increasingly difficult to thrive with existing business models, or to successfully scale up such models in an environment of geopolitical uncertainty.

Elowe believes political activism will be part of the collaborative solution: “Companies will have to get more involved in the political infrastructure and help to influence policies. Companies can no longer stand back” from politics. “We see the need for companies to try to influence political collaboration across geographies.”

Businesses will also have to assess emerging risks and be aware of how their current risk profiles may be changing in light of technological advances, political developments and environmental concerns.

“Firms need to be thinking about where they are placing their assets and manufacturing plants, what is their access to resources in the event of an environmental disaster, and what are the potential vulnerabilities in their supply chains,” Elowe says. And they should not limit their thinking – or risk management resources – to what risks can be mitigated or eliminated. “They will need to spend more time and thought around the resiliencies of their business and have more agile responses in place when an unexpected event occurs.”

对未来冲击做好准备

A section of the WEF report is devoted to consideration of future shocks or scenarios that have the potential to play out and cause cascading risks. The potential scenarios include: monetary populism, in which escalating protectionist impulses call into question the independence and authority of central banks; powerful quantum computing that renders cryptography and cyber protections obsolete; and the use of weather manipulation tools to stoke geopolitical tensions.

Drzik of Marsh says that the WEF report highlights how “leaders need to flex their business models, risk management processes, and corporate culture if they are to flourish in this environment.”

The Global Risks report was produced with Marsh & McLennan and Zurich Insurance Group as strategic partners. National University of Singapore, the Oxford Martin School, University of Oxford, and the Wharton Risk Management and Decision Processes Center, University of Pennsylvania, are academic advisers.

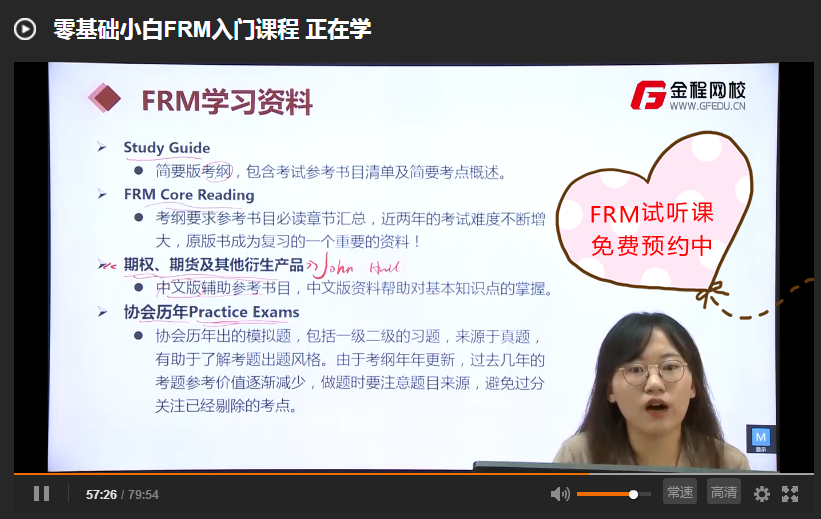

(FRM零基础入门课程,点击下方图片申请)

.jpg)

FRM官方交流群:909308278(点击直接加群)

▎来源金程FRM,更多内容请关注微信号金程FRM。原创文章,欢迎分享,若需引用或转载请保留此处信息。

FRM课程推荐

.png) |

|

|

| FRM一+二级特惠取证班 | FRM一+二级***计划 | FRM+CFA双证智能班 |

相关标签 FRM一级