【喜报】金程教育2017年11月FRM一级百题预测命中率高达92.5%!

最新公告 | 2018-01-02

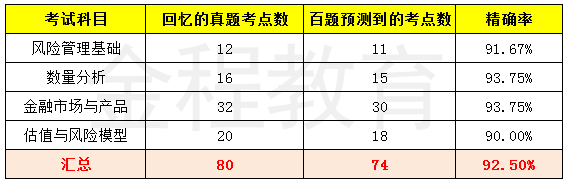

金程教育金融研究院快讯:2017年11月FRM考试刚刚落下帷幕,前方挑灯苦读多日的考生终于交上了自己的答卷。为掌握FRM考试考题走向,考试结束后,金程教育金融研究院第一时间进行FRM考题研讨。据统计,2017年11月由金程教育FRM培训师率领数位FRM研究员研发的FRM一级百题预测“命中率”再创新高,FRM一级4科命中率高达92.5%。

FRM考试结束的第二天,金程教育力邀参与考试的金程学员,第一时间现场交流反馈考试结果,帮助考生解析考点, 更为2018年FRM考生提供更有效的备考方向和应试技巧,事半功倍通过考试。不少学员也纷纷表示,金程的百题对于本次FRM考试很受用,知识点吻合度极高。

金程FRM一级考试预测命中率统计

*以上表格仅是根据金程教育FRM百题预测进行统计,结合金程教育FRM一级零基础长线班的汇总情况,金程教育FRM培训课程及推荐书籍几乎几乎全面覆盖了所有知识点。

2017年11月FRM一级百题“考点预测”示例

金程

1.1.考点:根据CAPM公式,算出组合收益率,同时判断是高估还是低估。

Patricia Franklin makes buy and sell stock recommendations using the capital asset pricing model. Franklin has derived the following information for the broad market and for the stock of the CostSave Company (CS):

Expected market risk premium 8%

Risk-free rate 5%

Historical beta for CostSave 1.50

Franklin believes that historical betas do not provide good forecasts of future beta, and therefore uses the following formula to forecast beta:

Forecasted beta = 0.80 + 0.20 × historical beta

After conducting a thorough examination of market trends and the CS financial statements, Franklin predicts that the CS return will equal 10%. Franklin should derive the following required return for CS along with the following valuation decision (undervalued or overvalued):

Valuation CAPM required return

A.overvalued 8.3%

B.overvalued 13.8%

C.undervalued 8.3%

D.undervalued 13.8%

Answer: B

The CAPM equation is: . Franklin forecasts the beta for CostSave as follows: beta forecast = 0.80 + 0.20 (historical beta) = 0.80 + 0.20(1.50) = 1.10The CAPM required return for CostSave is: 0.05 + 1.1(0.08) = 13.8%Note that the market premium, E(RM) - RF , is provided in the question (8%).

Franklin should decide that the stock is overvalued because she forecasts that the CostSave return will equal only 10%, whereas the required return (minimum acceptable return) is 13.8%.

全国咨询热线:400-700-9596

相关标签 FRM一级